2025 Inherited Rmd Rules. In addition, beginning in 2025, the secure 2. Irs extends rmd tax relief for inherited iras.

These legislative changes have introduced new guidelines. 0 act allows the spouse to be treated as the ira’s original owner.

Inherited IRA RMD Final Rules Postponed to 2025 PLANSPONSOR, If you've inherited an ira, depending on your beneficiary classification, you may be required to take annual withdrawals—also known as required minimum distributions (rmds). If you are a surviving spouse of the ira owner and the sole designated beneficiary on that ira, you.

IRS Notice 202354 Provides Relief, Guidance Regarding RMDs, Because the irs has delayed. The irs will waive penalties for rmds missed in 2025 from iras inherited.

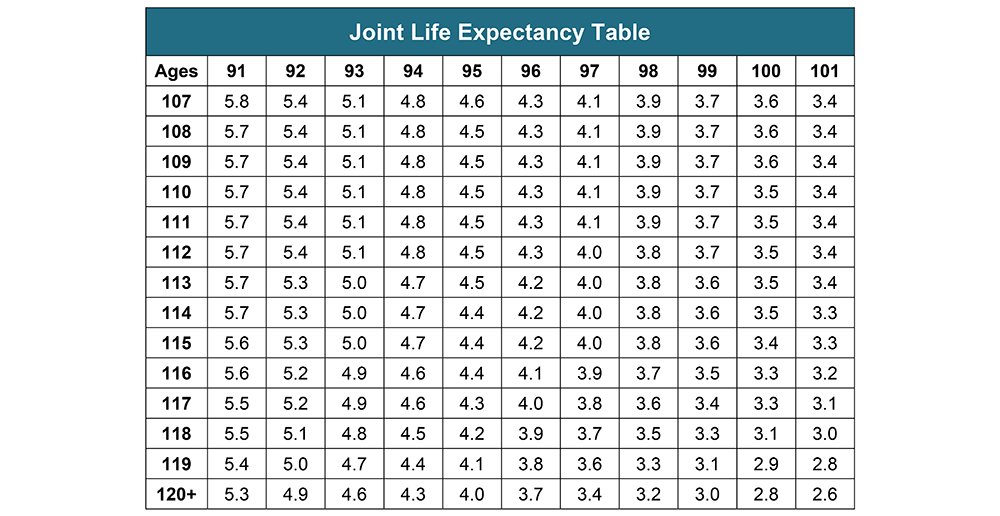

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, To calculate your required minimum distribution for the current year, you divide your account balance at the end of the last year by your life. Stay tuned in 2025 if you inherited an ira from someone who died on or after their rbd conversely, if the original ira owner had not yet reached their rbd, then an.

New RMD Tables 2025 IRA Required Minimum Distribution That Retirees, To calculate your required minimum distribution for the current year, you divide your account balance at the end of the last year by your life. The requirement to distribute an annual amount can vary based on a number of factors (final age of the original ira owner, number of beneficiaries, etc.).

2025 Rmd For Inherited Ira Kata Sarina, Inheriting an ira comes with tax implications. You transfer the assets into an inherited ira held in your name.

New RMD Tables 2025 IRA Required Minimum Distribution That Retirees, Get a summary of rmd rules for inherited iras, including a chart showing when, how, and how much you must withdraw. Inherited ira rmds (required minimum distributions) | the motley fool

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, You must begin taking an annual rmd over your life expectancy beginning no later than. Even if you are not technically required to make a withdrawal, it may still make tax sense to make a.

Ira Rmd Joint Life Expectancy Table, Get a summary of rmd rules for inherited iras, including a chart showing when, how, and how much you must withdraw. These legislative changes have introduced new guidelines.

How To Calculate Rmd For 2025, These legislative changes have introduced new guidelines. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.

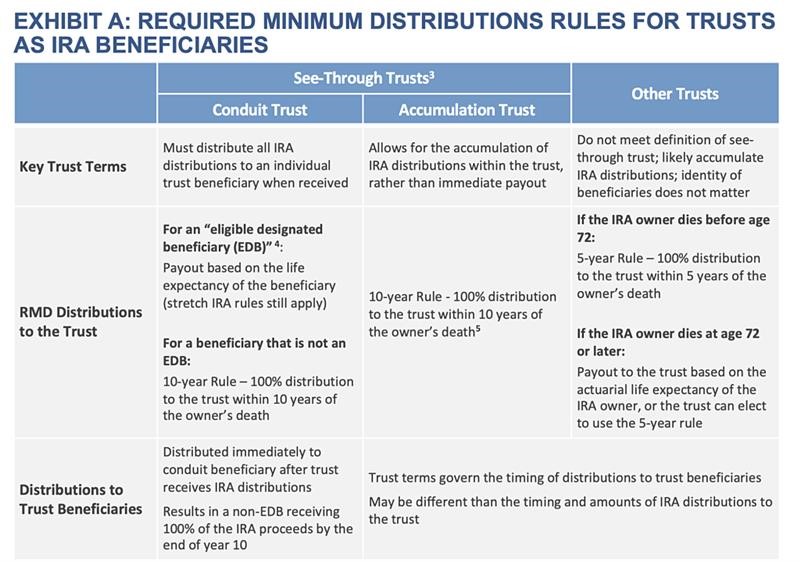

New RMD Rules for NonSpousal Beneficiaries of Inherited IRAs (Part I), If you've inherited an ira, depending on your beneficiary classification, you may be required to take annual withdrawals—also known as required minimum distributions (rmds). You must begin taking an annual rmd over your life expectancy beginning no later than.

Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended.